KNEC KCSE Past Papers Business Studies 2014

KCSE Past Papers Business Studies 2014

3.29.1 Business Studies Paper 1 (565/1)

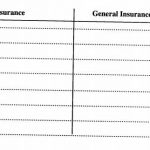

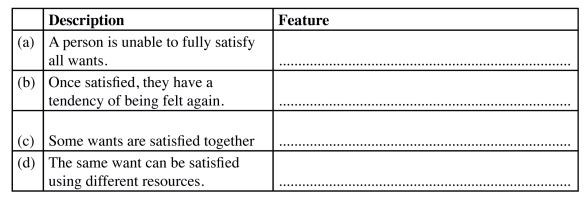

1 The following are descriptions of features of human Wants. Identify the features that relate to the descriptions in the spaces provided.

2 Name two occupations that relate to each of the production activities given below: (3 marks)

3 Outline four tasks that may be carried out by a receptionist in an office. (4 marks)

4.Highlight four circumstances in which a cheque may be used as a means of payment.(4 marks)

5 Highlight four activities that may be carried out in a stock exchange market.(4 marks)

6 Outline four features of liners in sea transport.(4 marks)

7 State five types of information that a manager may communicate to the juniors.(5 marks)

8 Explain the meaning of the following terms: (4 marks)

(a) Insured ………………………………………… ..

(b) Insurance …………………… ..

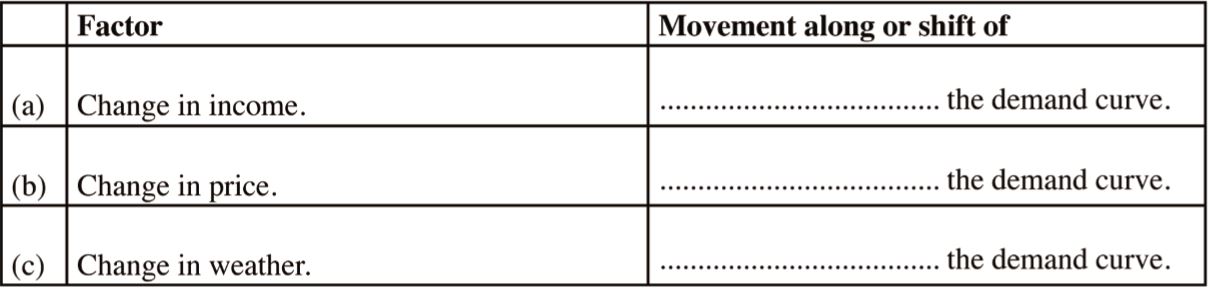

9 In the spaces provided below, indicate whether the following factors cause movement along the demand curve or a shift of the demand curve. (3 marks)

10 Highlight four roles played by the broker in the chain of distribution. (4 marks)

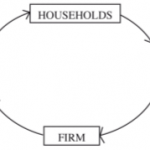

11 The following diagram represents the circular flow of income in a two sector closed economy.

Identify two factors represented by each of the arrows labelled a and b. (4 marks)

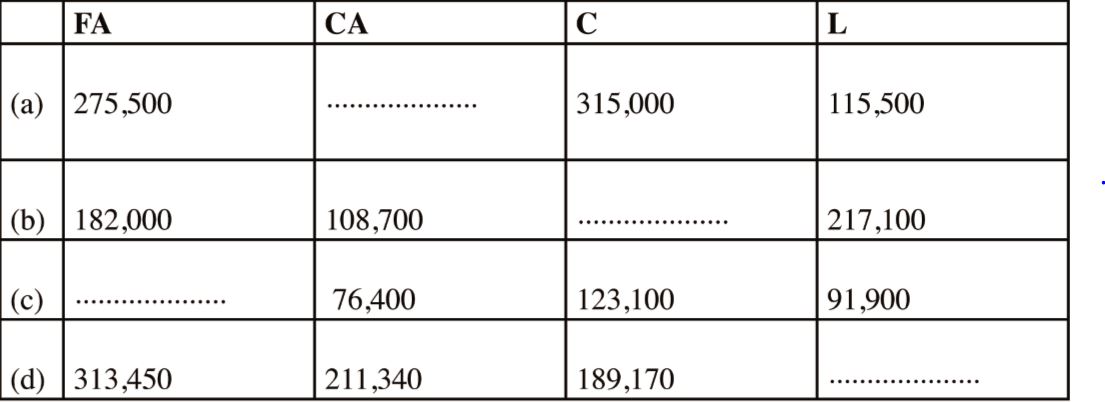

12 Fill in the missing figures in the table below:

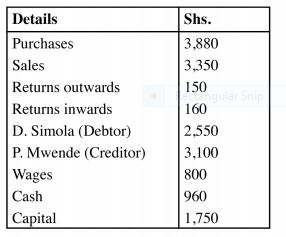

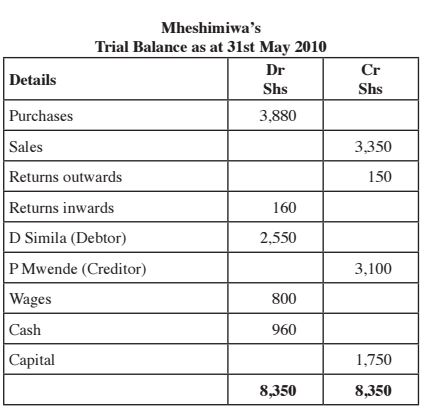

13 Mheshimiwa Ltd. had the following ledger account balances as at 31*‘ May 2010:

Required: Prepare Mheshimiwa’s trial balance as at 31*‘ May 2010. (5 marks)

14 The following is a format of the debit side of a three-column cash-book:

Name the columns labelled V, W, X and Y. (4 marks)

15 Outline four functions of the International Bank for Reconstruction and Development. (4 marks)

16 State four disadvantages of barter trade. (4 marks)

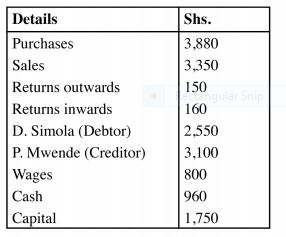

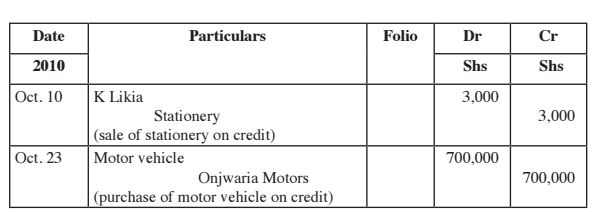

17 The following transactions relate to Jelimo Stores:

(a) 10″‘ October 2010, sold unused stationery for Sh 3,000 on credit to K. Likia.

(b) 23“ October 2010, bought a motor vehicle on credit from Onjwaria Motors for Sh 700,000.

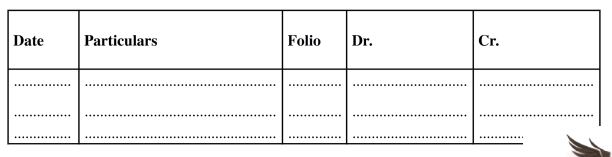

Required: Record the above transactions in the general Journal given below: (4 marks) Date Particulars Folio .

18 List four levels of inflation. (4 marks)

19 Many countries in Africa, Latin America and Asia are considered to be under-developed.

Outline four characteristics they have in common. (4 marks)

20 Madam Emoro operates a matatu business. State four factors in the internal environment that may influence the business. (4 marks)

21 Highlight four reasons for which businesses should observe ethical practices. (4 marks)

22 State four merits of promoting products through personal selling. (4 marks)

23 The following information relates to Kiboko Traders as at 31*‘ December 2010.

Details Shs

Total drawings 400,000

Added investments 800,000

Capital on 3 1“ Dec 2010 7,000,000

Profit 3,100,000

Calculate Kiboko’s initial capital. (3 marks)

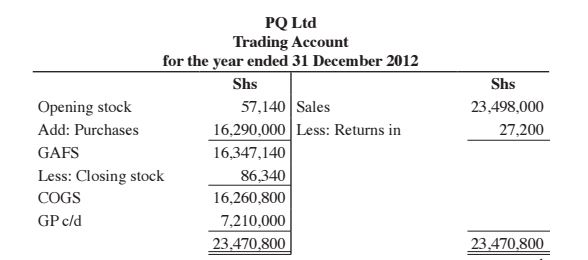

24 Outline four positive implications of a youthful population to an economy. (4 marks) 25 PQ Ltd had the following balances as at 31“ December 2012.

Shs

Sales 23 498 000

Stock 1/l/2012 57 140

Returns Inwards 27 200

Purchases 16 290 000

Stock 31/l2/2012 86 340

Prepare PQ’s Trading Account for the year ended 31“ December, 2012. (5 marks)

3.29.2 Business Studies Paper 2 (565/2)

1 (a) Explain five benefits that a firm may enjoy by preparing a business plan. ( l0 marks)

(b)Explain five demerits that a country may suffer when the government becomes a major investor in business. (10 marks)

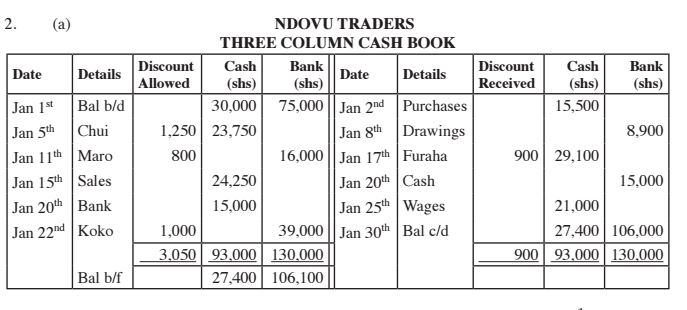

2 (a) On first January 2012, Ndovu Traders had shs 30,000 in cash and shs 75,000 at the bank. During the month, the following transactions took place:

January 2nd:Bought goods in cash Worth shs 15,500

5th: Received cash from Chui shs 23,750 after allowing 5% cash discount.

8th: Withdrew shs 8,900 from the bank for personal use.

11th: Maro, a debtor settled her account of shs 16,800 by a cheque of shs 16,000.

15th: Sales amounted to shs 24,250 in cash.

17th: Paid Furaha traders shs 29,100 in cash in full settlement of their account less 3% cash discount.

20th: Withdrew shs l5,000 from the bank for business use.

22nd: Koko a debtor, settled her account of shs 40,000 by cheque less 2.5% cash discount.

25th: Paid Wages shs 21,000 in cash.

Required;

Prepare a duly balanced three column cash book. (12 marks)

(b) Explain four reasons for which traders observe ethical practices in product promotion. (8 marks)

3 (a)Explain five objectives that may be achieved by establishing firms in different parts of the country (10 marks)

(b) Describe five accounting documents that are used in home trade. (10 marks)

4 (a) The following information relates to Bahati enterprises:

Details Shs

Stock 1*‘ January 2012 430 .000

Purchases 930,000

Sales 1,155,000

Carriage outwards 25 .000

Carriage inwards 10,000

Returns outward 20 .000

Returns inwards 30,000

General expenses 100.000

Insurance 25 .000

Stock 31st December 2012 470,000

Calculate:

(i) Turnover(1 marks)

(ii) Rate of Stock Turnover(3 marks)

(iii) Mark up(2 marks)

(iv) Margin(2 marks)

(v) Net profit(2 marks)

(b) Explain five guidelines that should be followed by the government in its expenditure. (10 marks)

5. (a) Explain five disadvantages that a developing country may suffer by liberalizing foreign trade. (10 marks)

(b) Explain five features of monopolistic competition. (10 marks)

6. (a) Apart from selling shares, explain five sources of finance for a public limited company. (10 marks)

There has been a decline in the demand for wooden furniture. Explain five factors that may have caused this trend. (10 marks)

4.29 Business Studies (565)

4.29.1 Business Studies Paper 1 (565/ 1)

1. Features of human wants as described are:

(a) Insatiable.

(b) Recurrent / Repetitive.

(c) Complementary.

(d) Competitive.

2. Occupations that relate to the production activities are:

(a) Extraction:

(i) mining.

(ii) fishing.

(iii) lumbering.

(iv) farming.

(b) Construction:

(i) bridge making

(ii) road construction.

(iii) ship building.

(iv) masonry.

(c) Direct services:

(i) hairdressing.

(ii) teaching.

(iii) health care.

(iv) entertaining.

3. Tasks that may be carried out by a receptionist in an office include:

(a) Receiving visitors to the organization.

(b) Receiving and routing telephone calls.

(c) Taking and passing messages.

(d) Dealing With simple petty cash for purchase of newspapers, tea etc.

(e) Supervising messengers.

(f) Keeping simple records.

(g) Distributing publications by the organization.

(any 4 x 1 = 4 marks)

4. Circumstances in which a cheque may be used as a means of payment include:

(a) When the amounts involved in the transaction are high.

(b) When the seller insists on payment by cheque.

(c) When evidence of payment is required.

(d) When payment is to be directed into the payee’s account.

(e) When the terms of sale is cash with order.

(f) When there is need to ensure safety of the money being transferred.

(any 4 x 1 = 4 marks)

5. Activities that may be carried out in a stock exchange market include:

(a) Buying and selling of shares.

(b) Mobilizing savings for investment.

(c) Listing of companies.

(e) Issuing of new securities / raising capital.

(f) publication of statistical information.

(g) Advising investors.

6. Features of liners in sea transport include:

(a) Ferry passengers or cargo.

(b) Follow a regular time table / schedule.

(c) Call at ports at regular intervals.

(d) Follow a regular route.

(f) Charge fixed freight age and fare regardless of demand.

(g) Form associations / conferences to protect themselves against unfair competition.

(any4x1 =4marks)

7. Types of information that a manager may pass to the juniors include:

(a) Instructions and directions.

(b) Explain policies of the organization.

(c) Give procedures to be followed in carrying out duties.

(d) Information on performance of juniors (evaluation).

(e) Invitation to meetings.

(f) Allocation / delegation of duties.

(g) Motivating / inspiring juniors.

(h) Giving solutions to juniors’ issues.

(any5x1 =5 marks)

8. Meaning of terms:

(a) Insured:

Is an individual or business unit that signs an insurance contract to be covered against a risk of loss and can therefore be compensated in the event of the loss occurring.

(b) Insurance:

ls an arrangement (contract) in which the insured pays premiums to the insurer so as to be compensated in case of loss occurring as a result of an insured risk. (2 x2 = 4 marks)

9. Indicating Whether factors cause movement along the demand curve or a shift of the demand curve:

(a) Shift of the demand curve.

(b) Movement along the demand curve.

(c) Shift of the demand curve.

(3 x 1 =3 marks)

10. Roles played by the broker in the chain of distribution include:

(a) Linking the buyer and the seller.

(b) Bargaining for the principal.

(c) Passing information between the principal and the client.

(d) Facilitating access to a variety of goods and services to the buyer.

(e) Providing an avenue for the seller to access many buyers.

(f) Giving advice to buyers and sellers on market trends.

(any 4 x 1 = 4 marks)

11. Factors represented by the arrows labelled a and b are:

(a) (i) Payment for goods and services.

(ii) Factor services / inputs / factors of production.

(2 x 1 =2 marks)

(b) (i) Payment for factor inputs.

(ii) Goods and services.

(2 x I =2 marks)

(Total = 4 marks)

12. Missing figures:

(a) CA = 155,000

(b) c = 73,600

(c) FA = 138,600

(d) 1. = 335,620

13.MheshimiWa’s

14. The columns:

V is Folio

W is Discount allowed

X is Cash

Y is Bank

(4 x 1 = 4 marks)

15. Functions of the International Bank of Reconstruction and Development include:

(a) Provision of finance to member countries to foster economic development.

(b) Issuance of loans to developing countries at concessionary rates for project development.

(c) Provision of personnel/manpower to facilitate project appraisal.

(d) Provision of experts to implement and manage identified projects.

(e) Training of local personnel in project appraisal and implementation.

(t) Supervise member countries’ management of public finance.

(g) Approving development plans from member countries for funding.

(h) Advising and recommending economic policies to be adopted by member countries.

(i) Promotes long term growth in international trade.

(any 4 x 1 = 4 marks)

16. Disadvantages of barter trade include:

(a) Lack of double coincidence of wants.

(b) Indivisibility of some goods.

(c) Perishability of some goods.

(d) Difficult to measure value.

(e) Problems of portability of some goods.

(t) Lack of a standard for making deferred payments.

(g) Lack of unit of accounts.

(any 4 x 1 = 4 marks)

17. Recording transactions into the general journal.

(4 x 1 = 4 marks)

18. Levels of inflation are:

(a) Hyper inflation/runaway.

(b) Galloping inflation/rapid.

(c) Stagflation.

(d) Creeping inflation/mild/moderate.

19.Characteristics of underdevelopment that are common among countries in Africa, Latin America and Asia include:

(a) Low per capita income.

(b) High population growth rate.

(c) Poor standards of living.

(d) Low literacy levels.

(e) High levels of unemployment.

(f) Poor health care.

(g) Low life expectancy.

(h) Over reliance on primary level of production/high levels of subsistence production.

(i) High dependency ratio.

(i) Poor infrastructure.

(k) Low technological levels.

(1) Large income disparities.

(m) Low levels of labour productivity.

(any 4 x 1 = 4 marks)

20.Factors in the internal environment that may influence the operations of a matatu business include:

(a) The management/structure.

(b) Employees.

(c) Capital / finances.

(d) The owner.

(e) Marketing strategy / handling of customers.

(d) Research and development.

(g) Condition of the vehicle.

(h) Business culture.

(any 4 x 1 = 4 marks)

21. Reasons for which businesses should observe ethical practices include:

(a) To ensure fair competition.

(b) To protect consumers/customers.

(c) To protect the environment.

(d) To protect the rights of employees.

(e) To promote social responsibility.

(f) To maintain a positive image.

(g) To abide by the country’s laws.

(h) To maintain suppliers.

(i) To promote positive cultural practices.

22. Merits of promoting products through personal selling include:

(a) Enhances personal appeal between the buyer and the seller.

(b) Can effectively counteract customers negative attitudes towards the product.

(c) Questions and complaints from customers are channelled directly to employees of the company and not middlemen.

(d) Demonstration on the use of the goods can easily be done.

(e) Flexibility in presentation to suit customer needs.

(t) Provide immediate feedback from and to the clients.

(g) Effective in conducting market research.

(any 4 x 1 = 4 marks)

23. Calculating Kiboko’s initial capital:

IC = CC + D — P — Al

= 7,000,000 + 400,000 — 3,100,000 — 800,000

= Shs 3,500,000

(6x é =3 marks)

24. Positive implications of a youthful population to an economy include:

(a) Less expenditure on social security and pension.

(b) Wider market for goods meant for the youth like clothing.

(c) Guaranteed continuous supply of labour.

(d) Flexibility and adaptability to technological changes which improve production.

(e) Faster growth of some sectors like the music, fashion and fast food industries.

(1) Increased innovation due to their adventurous nature.

(any 4 x 1 = 4 marks)

25.PQ Ltd

4.28.2 Business Studies (565/2)

1. (a) Benefits that a firm may enjoy by preparing a business plan include:

(i) Sourcing for finance/capital/loans. It can be used to convince financial institutions and investors to fund the firm’s operations.

(ii) A tool for evaluation. It can be used to determine whether the firm is achieving its goals and objectives/ help to make necessary adjustment/changes/ for supervision purposes.

(iii) A tool for management. It can be used for structuring the implementation of the functions /tool for planning, organizing, directing, staffing, coordinating budgeting/communicating.

(iv) Gives the firm a competitive edge. It enables the firm to get a better understanding of the market and competitors.

(v) Enhances efficiency in the use of the resources of the firm. It ensures that the resources available are allocated and used in the best way possible Without wastage.

(vi) Motivational tool. It inspires the management /employees /creates team work in accomplishing the objectives of the firm.

(vii) Framework /blue print/ guide for implementing a new business, thus assisting management in decision/actions on the (possible) strengths, weaknesses, opportunities and threats on a day to day basis.

(Any 5 x 2 = 10 marks)

(b) Demerits that a country may suffer when the government becomes a major investor in business include:

(i) Discourage private investment. The move may discourage private investment due to unfair competition and acquisition of monopoly powers/unfavourable laws.

(ii) Poor quality goods and services. The quality of goods and services may be compromised due to lack of competition. Government employees also lack enthusiasm since there is no profit motive.

(iii) Limited choices for consumers. Where the government is the only provider of good/service, consumers may be denied a variety to choose from.

(iv) Inefficiency. Leading to low/poor productivity/continuous loss.

(V) Burden to tax payers. The investments may drain public resources by increasing government expenditure in situations where the enterprise is not able to sustain itself (burdening tax payers).

(vi) Lack of accountability/transparency/corruption. Managers of government-run businesses tend to misappropriate and embezzle public funds/ misuse public funds.

(vii) Unstable management. Government-run businesses are prone to frequent changes in their management occasioned by changing political leadership.

(viii) Political interference/patronage. Appointment of cronies/nepotism and unethical practices may lead to social discontent.

(ix) Bureaucracy/red tape. Leading to rigidity/slow response to market changes.

(Any 5 x 2 = 10 marks)

2. (a)

(6 X 2 : 12 marks)

(b)Reasons for which traders observe ethical practices in product promotion include:

(i) To avoid misleading the consumers by not ma.king false claims about their products.

(ii) against their cultural values.

(iii) To ensure that consumers are not offended by not making use of appeals that go (iv) To avoid exploiting certain vulnerable groups like children since they lack the knowledge and experience to understand and evaluate the purpose of persuasive appeals.

(v) To avoid negative influence on the consumers’ values and lifestyles that may lead to immorality and ill health like glorifying the image of alcohol and cigarettes.

(vi) To avoid portraying rival businesses negatively in an attempt to capture the market or gain undue advantage.

(vii) To create a positive image reputation of business hence maintaining customer loyalty.

(vi) To abide by the laws of the country to avoid law suits/conflicts/frictions with law enforcement agencies/government.

(Any 4 X 2 = 8 marks)

3. (a)Objectives that may be attained by establishing firms in different parts of the country include:

(i) To reduce rural-urban migration. Setting up firms in several parts of the country may curb the influx of people from rural to urban areas. This helps to retain the productive population in the rural areas.

(ii) To utilize local resources/factors of production/untapped resources. Establishing firms in various parts of the country will enhance the use of idle resources in those areas.

(iii) To create employment opportunities. This is a sure Way of creating employment opportunities in several parts of the country which improves the standard of living.

(iv) To provide balanced regional development. Creating firms in various parts of the country will ensure that all parts grow/ develop at the same rate/time.

(v) To promote development of infrastructure. Setting up of firms will encourage the growth of infrastructure like roads, power, water, railway and communication in various parts of the country Which opens up the country and facilitates production/movement of goods/services/factors.

(vi) To promote development of social amenities / schools/ health facilities. When firms are set up in various parts of the country, social amenities Will also be developed. This improves the social welfare of the people.

(vii) To reduce social problems hence avoiding/minimizing pollution/crime/ prostitution/drug abuse/theft.

(viii) To promote urban growth hence encouraging growth of market/economy/ commercial activities.

(ix) To reduce congestion in certain areas in order to ease pressure on resources.

(X) To reduce effects of concentrated pollution which may negatively affect the environment.

(Xi) To minimize effects/impact of calamities/terrorism/catastrophe which may polarize the economy.

(xii) To reduce income disparities/inequalities as people will be engaged in production activities.

(any 5 X 2 = l0 marks)

(b) Accounting documents that are used in home trade include:

(i) Invoice. This is a document sent by the seller to a buyer demanding payment for goods supplied. It shows details of the goods, quantity, unit price, value, any discount given, net payment and terms of payment sold/bought on credit/a source document for sales/purchases day bool/A Ledger.

(ii) Debit note. A document sent by the seller to the buyer to correct an undercharge. It is issued when the invoice shows a lesser amount than what is actually owed. It is an additional invoice/may be used when empty containers have not been returned and have to be charged for.

(iii) Credit note. A document sent by the seller to the buyer to correct an overcharge.

It is issued when goods are returned to the seller because they are defective, not the ones ordered or they were not required. When returning empty containers (which had been charged for). A source document for sales returns/purchases returns day books.

(iv) Receipt. This is a document issued by the seller to the buyer when payment is made for goods / services. A source document for the cash book/cash payment journal/cash receipts journal.

(V) Statement of account. This is a document sent by the seller to the buyer showing details of transactions for the month with a running balance shown with each entry.

(vi) Payment voucher. A document used to validate payment for servicel goods rendered. It is issued by a cashier and signed by the service providerl payee/ recipient/a sources document for the petty cash book/impress used where the receipt is not readily available.

(vii) Remittance advice note. This is a document that accompanies a cheque issued for settlement of a debt. It provides information on the payment.

(viii) A1E (Authority to incur expenditure. written instructions allowing one to spend institutional funds up to a certain amount.

(iX) Bank deposit slip – As a source document for cash book/evidence of payment into the bank account.

(Xi) Consignment note supports hire of carriage services/shows transport charges.

4. (a) Calculating:

I. Turnover = Sales – Returns inwards = 1,155,000 – 30,000 = ShS 1,125,000 (4 ><% = 1 mark)

II. Rate of stock tumover (ROSTO)

Cost of goods sold

R°s‘° I

Cost of goods sold = opening stock + purchases + carriage inwards – Retum

outwards – closing stock

430,000 + 930,000 + 10,000 — 470,000 — 20,000

(430, 000 + 470,000) + 2

880, 000

I 450, 000

= 1.96 times

: 2 times

ROSTO = (12 ><% = 3 marks)

L

HI‘ Mark up : Cost of goods sold

_ 1,125,000 — 880,000

880,000

_ 245,000

‘ 820,000

_ 49 ~

– % _27.8%

1 (4><%= 2marks>

IV. Margin = %

_ 245,000

_ 1,125,000

_ 49 1

_ 225 or 21.77% (4X§:2markS)

V. Net profit = Gross profit – Expenses

= 245,000 – (25,000 + 100,000 + 25,000)

= 95,000

(Q Xi. : 7 rnm”lzq\

661 §~

(b) Guidelines that should be followed by the government in its expenditure include:

I. Maximum social benefit/optimal benefit. Government spending should benefit as many people as possible.

II. Flexibility. Should be elastic enough to accommodate changing circumstances.

III. Economy. Should be capable of being changed to accommodate prevailing economic circumstances.

IV. Equity. Should aim at distributing incomes fairly.

V. Sanction. Government spending must be approved by the relevant authority to enhance accountability.

VI. Accounting. Proper accounting records should be kept to facilitate good financial management.

VII. Productivity. A larger proportion of the national income should be spent on development projects.

VIII. Surplus. Expenditure should be less than the total revenue collected.

IX. Elasticity – should be capable to being expanded/contracted depending on the size of the economy.

(Any 5 x 2 = 10 marks)

5. (a) Disadvantages that a developing country may suffer by liberalizing foreign trade include.

(i) May lead to dumping of inferior products into the country.

(ii) May cause over exploitation of resources leading to their depletion.

(111) May lead to loss of jobs due to closure of firms that cannot cope with competition.

(iv) May contribute to worsening balance of payment situation as developing countries have fewer/ lowly valued exports.

(v) Cultural values and beliefs may be eroded due to unrestricted trade.

(vi) Entry of harmful goods. Goods with harmful ingredients such as beauty creams and drugs may find their way into the country.

(vii) Slow economic development. The country may stagnate due to over dependence on other countries for supplies.

(viii) Brain drain. The developing country looses skilled personnel to better developed countries Who provide better pay and amenities.

(b)Features of monopolistic competition include:

(i) Many sellers and buyers. The market is comprised of many sellers and buyers who operate independently.

(ii) Free entry and exit into the market. There are no barriers to entry into, or exit from the market.

(iii) Commodities sold are very close substitutes. Firms sell similar products but which are highly differentiated by names, shapes, colour, odour and packaging.

(iv) All firms earn normal profits in the long run. Some firms may earn super normal profits in the short run.

(v) Firms are independent. There is little interdependence in terms of pricing and quantities to produce.

(vi) Entry or exit of a firm does not significantly affect the market. None of the firms can influence the market supply by joining or leaving the industry.

(vii) No single firm has control over the factors of production. All firms acquire the factors at the prevailing market rates and conditions.

(Viii) Perfect knowledge of the market. Buyers and sellers are aware of the prices, quantities and other market factors.

(Any 5 x 2 = 10 marks)

6. (a)Sources of finance for a public limited company apart from the sale of shares include:

(i) Borrowing from financial institutions in the form of loans, bank overdraft and mortgage.

(ii) Trade credit. Buying goods for re-sale on credit so as to pay at a later date.

(iii) Hire purchase. Buying goods and paying for them on instalment basis.

(iv) Debentures. Borrowing from members of the public for which interest is paid at a fixed rate and over a predetermined period of time.

(v) Sale and leaseback. Selling an asset like a building and then hiring it back for a specified period of time.

(vi) Retained profits. Profits made are not shared out as dividends but ploughed back into the business.

(vii) Discounting bills of exchange. Receiving payment from financial institutions at a discount against bills of exchange before their maturity.

(viii) Use of reserves/ provisions. The company may make use of funds set aside for depreciation, tax and bad debts to finance its day to day operations.

(Any 5 x 2 = l0 marks)

(b) Factors that may have caused a decline in the demand for Wooden furniture include:

(i) Decline in consumer incomes. This may reduce their purchasing power hence less able to afford the furniture.

(ii) Fall in the price of substitutes. Furniture made from other materials like plastic and metal may be cheaper.

(iii) Increase in the price of Wooden furniture. This makes the furniture to be out of reach for most consumers.

(iv) Government policy. The government may have increased rates on timber products hence making the furniture more expensive.

(v) Unfavourable change in tastes and preferences. Consumers may be purchasing more plastic and metallic furniture.

(vi) Decline in population. A decrease in population Will lead to reduced numbers of potential and actual customers.

(vii) Expectations of a future fall in price. Consumers may be anticipating a fall in price in the future hence currently suspend buying.

(Any 5 x 2 = 10 marks)