KNEC KCSE Business Studies Paper 2 Question Paper / 2016 KCSE KAMDARA JET Examination

2016 KCSE KAMDARA JET Examination

Business Studies Paper 2

(a) Explain five factors that may contribute to low level of National

Income. (10 mks)

(b) Explain five reasons for trade restriction (10 mks)

20 marks

(a) Explain five advantages that may be associated with operating a tied

shop. (10 mks)

(b) Explain five challenges of a young population. (10 mks)

20 marks

(a) Explain five circumstances under which a pro-forma invoice may be

used (10 mks)

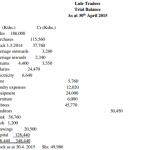

(b) Kisii Traders had the following balances as at 31st December 2014.

| Bank Loan 3 years Buildings Creditors Debtors Furniture Gross profit Motor vehicle Discount allowed Lighting Interest on loan Closing stock Rent Received Repairs on buildings Repairs on furniture Repairs on motor vehicle General expenses Capital |

Shs 472,500 540,000 227,000 116,900 408,170 520,600 900,000 142,000 25,200 1,200 72,500 120,000 60,000 72,030 300,000 102,100 1,400,000 |

Prepare:

(i) Profit and loss account for the year ended 31st December 2014.

(ii) Balance sheet as at 31st/12/2014. (10 Marks)

20 marks

(a) Explain five reasons that may make an insurance company refuse to

compensate the insured in the event that a risk occurs. (10Marks)

(b)Explain five circumstances under which a manufacturer would sell his

goods directly to a consumer. (10 Marks)

20 marks

(a) Explain five differences between direct tax and indirect tax. (10 Marks)

(b) Explain five ways in which advertising agencies assist in sales promotion. (10Marks)

20 marks

(a)The use of motor cycle transport is becoming very popular in both rural and urban areas of Kenya. Explain the limitations a business that relies

on its use is likely to encounter. (10Marks)

(b) The following information relates to Malindi Traders for the year ended

31st December 2015.

| . Total current assets Total Fixed assets Total current liabilities Total long term liabilities Net Profit Capital Sales Opening stock Closing stock Margin |

Shs 587,500 720,000 32,500 357,500 50,000 625,000 1,000,000 50,000 25,000 20% |

Calculate:

(i) Working capital (2 mks)

(ii) Current ratio (2 mks)

(iii) Mark-up percentage (2 mks)

(iv) Rate of stock turnover (2 mks)

(v) Return on capital (2 mks)

20 marks